Bigger rebates, not a gas tax holiday, will help Virginians

Virginia budget negotiators typically reach agreement before the first pitch of baseball's opening day in April. Presently, they remain at odds over how best to allocate surplus revenues generated by our booming economy in the aftermath of the pandemic. But if their challenges were not complicated enough, Governor Youngkin, still finding his way in understanding the legislative process, waited until after the session ended to throw lawmakers a political curveball by proposing a gas tax holiday. Not only is this questionable policy but will make reaching an agreement on the budget more difficult.

Democrats and Republicans clearly understand the impact of inflation on family budgets and have already embraced various forms of tax relief. They also feel the pinch themselves at the gas pumps, and clearly want to help. They are not alone. Several states have presently enacted gas tax holidays, and some twenty others are considering them during their legislative sessions. Red state Georgia, blue state Connecticut, and a state with a blue legislature and a republican governor (Maryland) have already enacted these holidays and other states as diverse as California and Alabama are considering them. But is this form of relief even a good idea? And might some other approach provide better relief to inflation-impacted Virginians?

First, studies predict a relatively small benefit from the gas tax holidays. Forbes analyzed numbers for three states – Connecticut, Georgia, and Maryland– and projected average savings between $14 and $34 per driver, depending on the length of holiday.

Second, it is not clear how much this will affect prices at the pump. Gas prices are products of many factors, and some studies predict that much of the alleged benefit of the gas tax holidays is simply to increase profit margins for oil and gasoline companies. Analyses by the Institute on Taxation and Economic Policy and Virginia’s Commonwealth Institute argue that 30% of the projected savings would likely flow to oil producers rather than motorists, and project that less than 30% of the benefit would reach Virginia residents. Even the governor, when pressed about whether

his proposal will reduce the cost at the pump, had to admit that “We can’t guarantee anything…”

Third, the governor’s proposed gas tax holiday is using our tax dollars to benefit out-of-state drivers who purchase gas here while traveling through the Commonwealth. If you do not own a car or don't drive very much, you receive little relief. And a gas tax holiday is simply removing funds from much needed projects that build critical transportation infrastructure while providing good paying jobs to thousands of Virginians.

A simpler way to provide relief to Virginians is to double-down on a concept that already enjoys bipartisan support— a one-time tax rebate. Under this measure, rebates of $300 per person and $600 per family would be sent to all Virginians. If legislators simply added another $50 to these rebates, more money would flow to Virginians than the governor’s gas tax holiday, and the benefits would be spread more widely. And if budget writers and the governor are interested in providing relief to those most in need, they could increase the refundability of the Earned Income Tax Credit (EITC). With direct rebates, the state and its residents will know precisely who gets what.

Jettisoning the gas tax holiday in favor of broader based relief will make it easier to reach agreement on the budget, something that is required by our constitution to occur before the end of June. Perhaps it is time for the governor to serve up a slow-pitch for the legislature and remove politics from the budget making process.

State Supreme Courts Open New Front in the War on Hyperpartisan Redistricting

Election Law Blog Article

Ohio, Pennsylvania, and North Carolina have been on the frontlines of partisan division for over a decade, often being viewed as swing states in national electoral contests. Now, each state’s Supreme Court occupies a similar position—making waves by using their state constitutions to overturn partisan redistricting maps and leveling the playing field for the parties in the upcoming midterm elections…

Read my full article on Election Law Blog

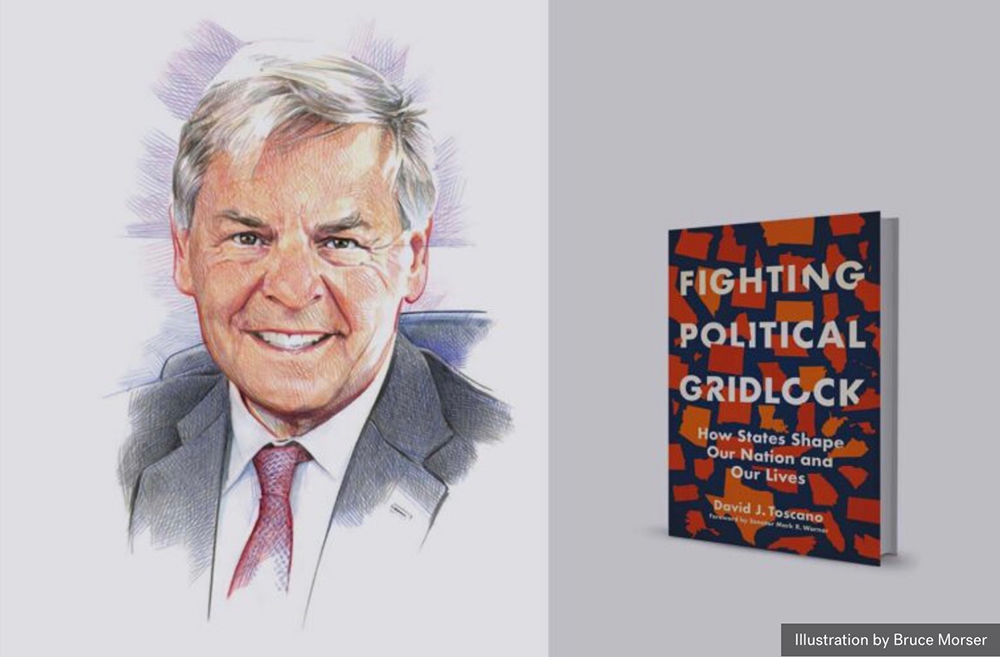

Great States from Colgate Magazine

“In 2019, Democrats in Virginia took control of the House of Delegates and the State Senate, giving the party complete control of government for the first time in 26 years. Throughout the next two years, the commonwealth enacted one progressive reform after another — including repealing the death penalty, expanding Medicaid, and passing a $12 minimum wage. No one was more pleased to see those changes than David Toscano…”

You can read the full article on Colgate Magazine.

How States Shape the Nation

NCSL Podcast with Tim Storey

NCSL Podcast with Tim Storey

David Toscano was the guest on NCSL “Legislatures: The Inside Storey” podcast with host Tim Storey. The podcast link is here and the transcript is here and can be read immediately below: